Market Capitalization Write For Us

Market capitalization, frequently referred to as “market cap,” is a fundamental financial metric that plays a significant role in evaluating and understanding companies in the stock market. It is a vital tool investors, analysts, and financial professionals use to assess a company’s size, scale, and overall worth.

Market capitalization, frequently referred to as “market cap,” is a fundamental financial metric that plays a significant role in evaluating and understanding companies in the stock market. It is a vital tool investors, analysts, and financial professionals use to assess a company’s size, scale, and overall worth.

What is Market Capitalization?

Market capitalization measures the total value of a publicly traded company’s outstanding shares of stock. It represents the market’s perception of a company’s worth and is calculated by growing its current stock price by the total number of unsettled shares. The result is the total dollar value of a company’s equity.

Calculating Market Capitalization

To calculate market capitalization, you need two pieces of information: the current stock price and the total number of outstanding shares. The formula is straightforward:

Market Capitalization = Current Stock Price x Total Outstanding Shares

For example, if a company’s stock trades at $50 per share, with 100 million remaining claims, the market capitalization would be $5 billion ($50 x 100 million).

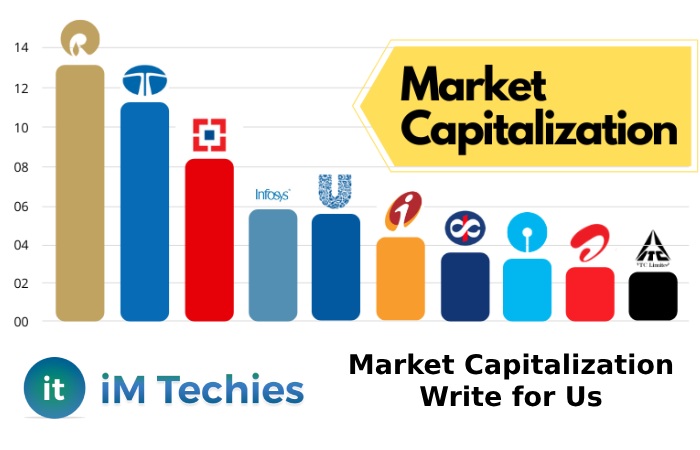

Market Capitalization Categories

Market capitalization is often used to categorize companies into different size classes:

- Large-Cap: Companies with a market capitalization above $10 billion are generally considered large-cap companies. These are often well-established, industry-leading firms with a stable revenue stream.

- Mid-cap: Companies with market capitalization between $2 billion to $10 billion fall in the mid-cap category. They are generally established companies that have significant growth potential.

- Small-Cap: Businesses with a market capitalization between $300 million and $2 billion are considered small-cap. These companies often have the potential for rapid growth but may also carry higher risks.

- Micro-Cap: Companies with a market capitalization below $300 million are termed micro-cap. These companies are usually small and relatively new, with the potential for high growth and higher volatility.

Importance of Market Capitalization

Market capitalization holds several critical implications and is essential for various reasons:

- Investment Decision-Making: Market cap is a crucial factor for investors when making investment decisions. It helps investors gauge the size and stability of a company, which can influence their risk tolerance and overall investment strategy.

- Index Composition: Market capitalization plays a significant role in determining the composition of various stock market indices. For example, the S&P 500 is a popular index of 500 large-cap companies, while the Russell 2000 tracks 2,000 small-cap companies.

- Benchmarking Performance: Market cap-based indices are benchmarks for investors and fund managers to assess their portfolio’s performance against the broader market or a specific sector.

- Sector and Industry Analysis: Analyzing market capitalization within specific sectors or industries allows for better comparison and understanding of a company’s relative position and competitiveness.

- Financial Strategy: A company’s market capitalization can influence its financial strategy. Large-cap companies may have access to cheaper financing and better terms, while smaller companies may rely on equity offerings or venture capital.

Limitations of Market Capitalization

While market capitalization is a valuable metric, it has its limitations. It solely focuses on the current stock price and outstanding shares, overlooking other crucial factors such as debt levels, earnings, and growth prospects. Market capitalization can fluctuate significantly with stock price movements, leading to potential short-term distortions in a company’s perceived value.

How to Submit Your Articles?

For Submitting Your Articles, you can email us at contact@imtechies.com

Why Write For Im Techies – Market Capitalization

- You can reach your target audience/customers and might be a reader of our blog, and you can have enormous exposure

- You can get a backlink to your website. As you distinguish, the backlink will share your SEO value.

- Can also build a relationship with your targeted customers/audience.

- Target both categories, like marketing and business, separately or together.

- We are also available on social platforms like Facebook, Twitter, and LinkedIn so that we will share your guest post on all the social media platforms.

- Your brand’s authority and content will be known worldwide if you write for us.

Some Search Terms that are Related to Market Capitalization

publicly traded companies

outstanding common shares

why is market cap important

how does market cap affect stock price

global market cap trillion

market price per common share

capital structure

enterprise value

embedded value

stock

net worth

stock markets

economic regions

economic indicators

Search Terms for Market Capitalization Write For Us

“guest post”

“write for us.”

“guest article”

“submit blog post.”

“contribute to our site.”

“This is a guest post by.”

“looking for guest posts.”

“contributing writer”

“want to write for.”

“contributor guidelines”

“contributing writer”

“submit news”

“submit post”

“guest post

“write for us.”

“guest article”

“guest post opportunities”

“This is a guest post by.”

“Become an Author.”

“guest author”

“Send a tip.”

“guest blogger”

“guest posts wanted.”

“become a guest writer.”

Guidelines for Article for Writing Market Capitalization Write for Us

- The guest article should contain at least 800+ or more words.

- The article must be valuable and helpful to the peruser – no limited time language.

- The article should be 100% Unique and copyright violation free and must not contain any syntactic mistakes.

- In any event, The article or blog entry must contain two main pictures with copyrights.

- The point should be identified with mastery: wellness, health, eating fewer carbs, weight loss, food, magnificence, cosmetics, and style.

- Our QC’s will cross-check the substance procedure, specialized SEO, and connection condition. On the off chance that the whole thing is as per our rules, at that point, the article live connection will send to you within 12 hours

For Submitting Your Articles, you can email us at contact@imtechies.com

Related Pages:

Root Cause Analysis Write for us