Financial Scams Write For Us

Financial scams against the elderly is widespread and expensive. The FBI estimates that seniors lose over $ 3 billion to scammers annually. Scammers persecute older people because they believe older people have a lot of money in their accounts.

But it’s not just wealthy seniors that are being targeted. Low-income elders are also at risk of financial abuse. And it is not always foreigners who commit these crimes. Family members of an older person dedicate over 90% of all reported elder abuse, mainly their adult children, followed by grandchildren, nieces, and others.

The most common scams at Lason are:

In a three-way phone call, the fraudster pretends to be interested in buying a product or service from the victim. He contacts them to make a purchase and transfer through a bank intermediary (the second scammer). As soon as a so-called bank agent contacts you, he will ask for your personal and account information.

On the other hand, there is a call to a bank clerk when a prospective agent contacts him to update information or resolve an alleged problem. In any case, they will ask you for confidential information or instructions on accessing a fraudulent website or web page.

Phishing is an email technique believed to help banks secure accounts and allow sensitive information such as passwords, account numbers, card numbers, and other personal information.

Five tips to protect your data and detect fraud

When you receive a call from a financial institution, be careful not to provide sensitive information such as access passwords or security codes. If you have any questions, reject the call and contact the facility directly for clarification.

To avoid phishing, maintain good messaging and social media habits. Don’t open attachments or unwanted links that redirect you to other websites. Very important: And also, Protect your passwords. You must not disclose them to anyone.

Therefore, best way to battle fraud is to systematically refuse communication by phone or email asking for personal or confidential information, installing an application, or performing transactions from your computer.

Phishing can occur while browsing the Internet and on legitimate-looking websites. For this reason, you need to check the spelling of the web address or URL. Also, update your browser as a preventive measure and install appropriate security fixes.

Expect to phish. If you have never visited your bank’s website in English or another language, you should not receive statements in that language. And also, False messages are easy to spot and are often poorly written or translated into multiple languages.

Financial and banking companies have an ally at Predisoft

- At Predisoft Internacional SA, we have developed system software to detect bank fraud, financial fraud, and multiple channels.

- PS Fraud combines knowledge of fraud patterns, customer behavior, and expertise in a systematic self-learning model.

- PS Fraud is based on three main pillars:

- Therefore, customer behavior profile is mathematically modeled using symbolic vectors for fraud detection.

- Dynamic models based on the institution’s historical fraud.

- Specialist rules.

- At Predi soft, we are constantly updating information to offer the best fraud detection and prediction tools using the latest technology.

- Contact us to learn more about PS Fraud and how this software tool can help you avoid banking and financial fraud.

How to Submit Your Articles

For Submitting Your Articles, you can email us contact@imtechies.com

Why Write For – Imtechies Financial Scams Write for Us

Search Terms Related to Financial Scams Write For Us

Computer tech support scams

Financial frauds in India 2020

Biggest financial frauds in history

Scammer alert website

Scammer website

Biggest scams in India

How to identify a scammer on the phone

Scamming examples

Investment frauds examples

Financial scams definition

Types of financial scams

Common financial scams

How to recognize financial scams

Financial scams prevention

Reporting financial scams

Investment fraud

Ponzi schemes

Pyramid schemes

Advance fee fraud

Phishing scams

Identity theft

Wire transfer scams

Online auction scams

Credit card fraud

Mortgage fraud

Charity scams

Tax scams

Social engineering scams

Binary options scams

Search Terms for Financial Scams Write For Us

- Write for us financial scams

- Financial scams guest posting

- Contribute to financial scams blogs

- Financial scams writer opportunities

- Submit guest post financial scams

- Financial scams blogger wanted

- Financial scams content contributor

- Guest author for financial scams

- Financial scams blog submissions

- Financial scams author guidelines

- Financial scams writing opportunities

- Financial scams contributor program

- Financial scams writing submissions

- Write for financial scams websites

- Financial scams content creator

- Financial scams guest writer

- Financial scams blog writer

- Financial scams article submissions

- Financial scams blog contributor

- Financial scams writing guidelines

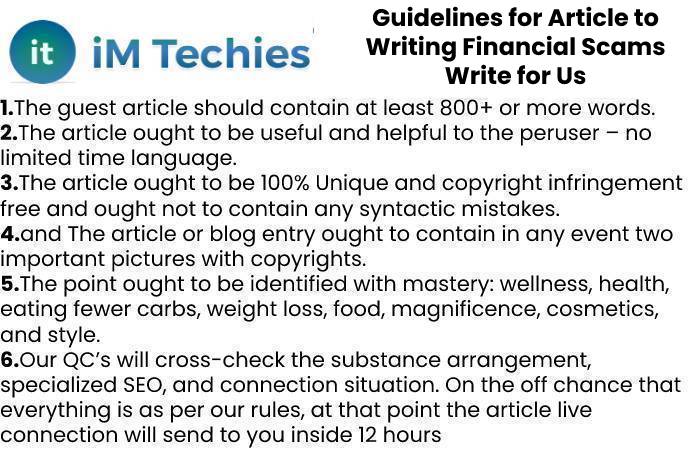

Guidelines for Article to Writing Financial Scams Write for Us

For Submitting Your Articles, you can email us contact@imtechies.com

For Submitting Your Articles, you can email us contact@imtechies.com

Related Pages:

Financial technology write for us

Powerpoint templates write for us

Root Cause Analysis Write for us